Published

- 4 min read

How to Register as a Sole Proprietor in Korea | A Guide for Freelance Developers

How to Register as a Sole Proprietor in Korea | A Guide for Freelance Developers 💼

I’ve been working as a developer for 4 years on the side. While keeping my full-time job, I decided to register as a sole proprietor in Korea to manage my side income more professionally.

If you’re a freelance developer or foreigner working remotely in Korea, you might be wondering if you should register a business. This guide covers why you should register, how to do it, and key tax tips for freelancers operating in Korea. 💡

1. Freelancing vs. Sole Proprietorship vs. Corporation 🔍

| Type | Freelancer | Sole Proprietor | Corporation |

|---|---|---|---|

| Taxation | Withholding tax (3.3-8.8%) or comprehensive income tax (6-45%) | Comprehensive income tax (6-45%) | Corporate tax (10-20%) + additional dividend tax |

| Tax Filing | Simple (Company handles withholding tax) | More complex, but simplified bookkeeping available for income below KRW 80M | Full accounting required (Hiring a CPA is recommended) |

| Social Insurance | No mandatory 4 major insurances | No mandatory 4 major insurances | Required except for employment insurance |

| Business Growth | Limited | Difficult to attract investors | Ideal for scaling a business |

| Best For | Annual income under KRW 48M | Annual income under KRW 100M | Income above KRW 100M, planning for business expansion |

💡 Conclusion: If you’re a freelance developer, registering as a sole proprietor is beneficial for tax purposes and professional credibility. However, if you don’t want to deal with tax filings, staying as a freelancer might be better. If your income exceeds KRW 100M, consider incorporating.

2. How to Register a Sole Proprietorship in Korea 📝

✅ Requirements

- Digital Certificate (Joint Authentication) for Hometax Login (No simple authentication allowed)

- Lease contract copy (if renting an office/workspace)

- Partnership agreement (for joint startups)

- Industry-specific documents (Check Hometax for details)

- Registration available between 06:00 - 24:00 (Public holidays included, but unavailable at midnight)

📌 Tip: If online registration is complicated, visit the local tax office for assistance.

📌 Official Link: National Tax Service Hometax Business Registration

🚀 Steps to Register Online

1) Log in to Hometax

📌 Hometax Login:

➡️ Visit Hometax

➡️ Log in using Joint Authentication Certificate (Formerly Public Certification)

💡 Mac Users: If you’re using Chrome and encounter a compatibility error with electronic signatures, try logging in via Safari instead.

2) Navigate to Business Registration

📌 Path:

Tax Certificates > Business Registration > Sole Proprietor Registration

⚠️ Note: Hometax updates frequently, so menu locations may change.

3) Choose Business Type and Enter Details

If you’re a freelancer, choose the appropriate industry classification:

- Software Development Freelancers: Code

940926 - General Freelancers: Code

940909

💡 As of 2022, software development freelancers have a separate classification.

4) Check Eligibility for Simplified Taxation

📌 Want easier tax reporting?

➡️ Select the Simplified Taxation option

➡️ Check eligibility via “Preliminary Simplified Tax Review” button

5) Upload Required Documents

- If renting an office/workspace: Upload a lease contract copy

- Freelancers do NOT need a business plan (If required, a simple version is acceptable)

6) Submit Application & Confirmation!

✅ If no issues arise, approval is usually granted within a business day. I submitted my application on a Saturday night and got approved by Monday morning—no phone verification required!

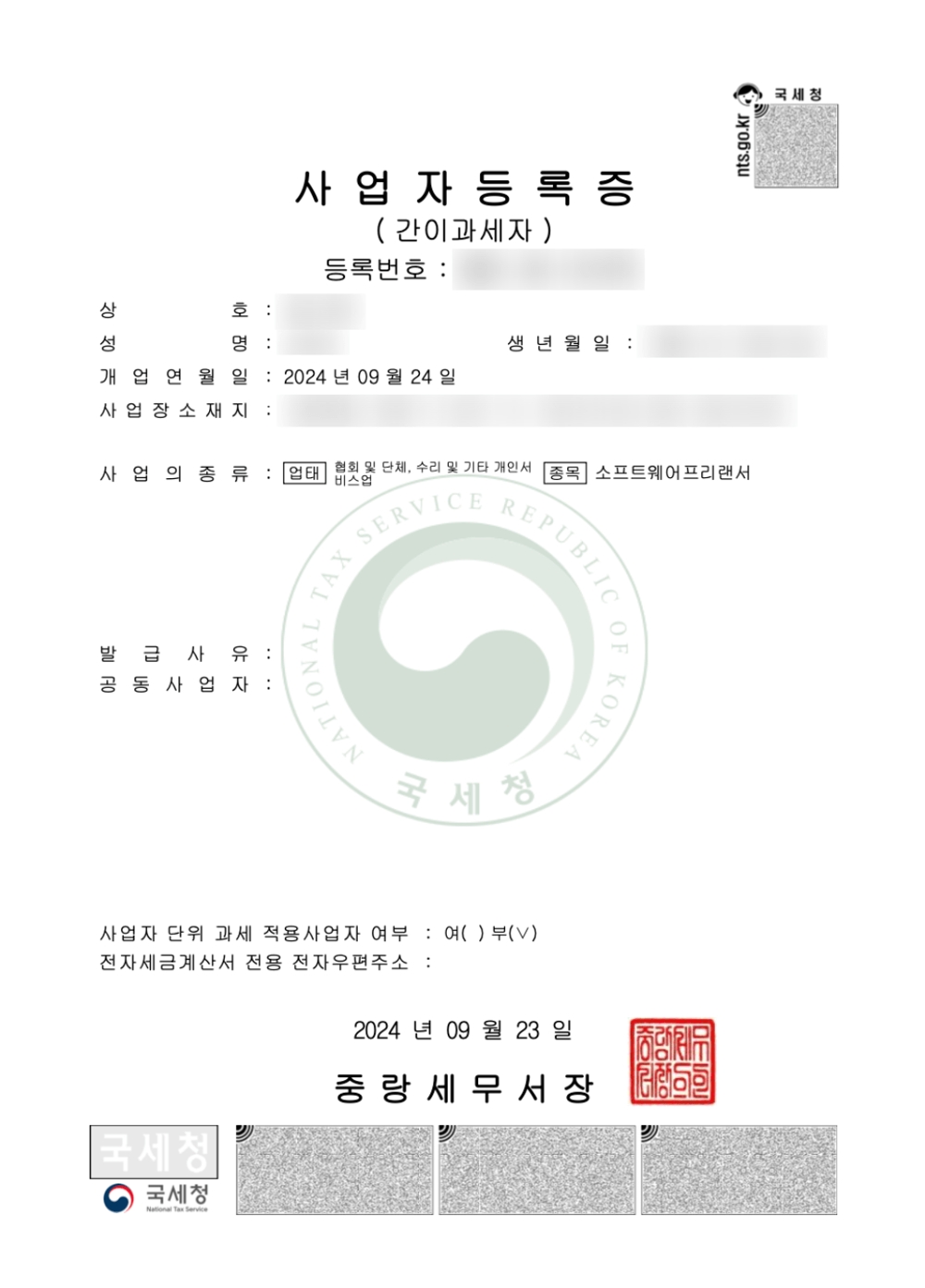

✅ After approval, you can download your business registration certificate from Hometax.

3. Tax Management After Registration 💰

💡 VAT & Income Tax Filing

- VAT Filing: January & July (Only once a year for simplified taxpayers)

- Income Tax Filing: May every year

- Expense Deductions: Business-related expenses such as equipment, software, internet bills can reduce taxable income

📌 Tip: Use Hometax’s electronic bookkeeping for easier tax management, or keep track manually using Excel!

💡 Google AdSense & Freelancers in Korea

- AdSense earnings are classified as Other Income under Korean tax law

- If your main income source is AdSense, register an additional business category (can be updated later)

- Registering as a sole proprietor allows for better expense deductions & tax benefits

4. What Changed After Registration? 🎉

✅ Increased Credibility: More professional image when signing contracts

✅ Tax Benefits: Expense deductions lower actual tax payments

✅ Potential for Business Growth: Easier transition to incorporation in the future

Personal Experience After 6 Months

To be honest, I haven’t felt a drastic change in professionalism or business expansion yet. However, I did notice significant tax benefits.

Previously, all my freelance income was subject to an 8.8% withholding tax, but now as a simplified taxpayer, I only pay 3.3% upfront and handle the rest at the end of the year. This allowed me to keep more of my earnings while legally reducing taxes.

Additionally, simplified taxpayers don’t pay VAT, which further maximized my earnings.

If you’re considering business registration, think about how you plan to operate long-term and whether these tax benefits align with your income goals. 🚀

📌 Considering freelancing in Korea? Business registration might be the next step for you!